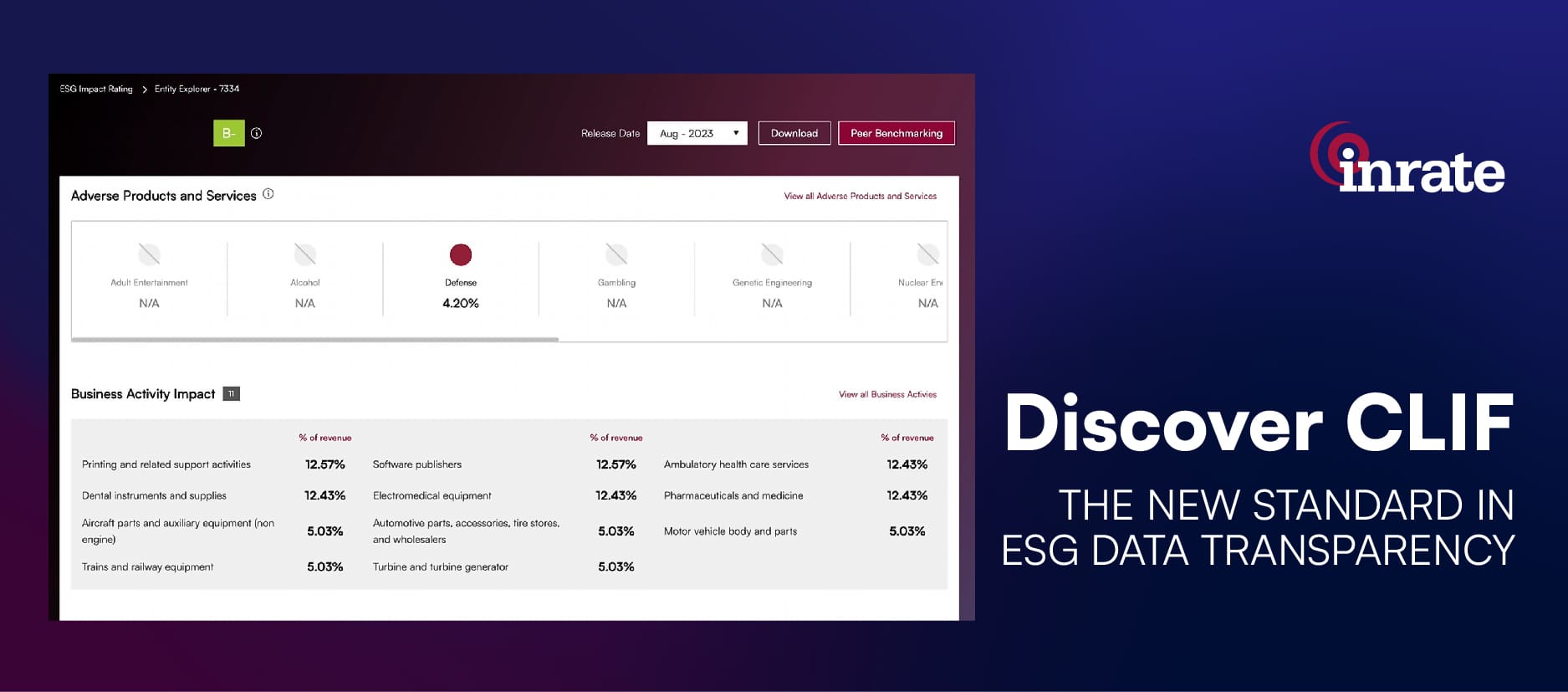

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insights

Zurich, Oct 22, 2024 – Inrate, a leading impact rating and ESG data...

Inrate Welcomes Saurabh Srivastava as Head of Sustainability Data & Ratings

Zurich, Sept 12, 2024 Inrate, a leading sustainability data and ESG...

SIX Launches Climate Data Sets to Support Climate-related Reporting, Investing

Financial market infrastructure provider SIX announced today the...

Inrate Shortlisted for “Best Specialist ESG Ratings” at ESG Investing Awards!

Inrate Joins Forces! Founding Member of New European Sustainability Rating Body

With a legacy of 30 years, Inrate is honored to be a founding member of the European Association...

Inrate Empowers TMX ESG Data Hub

Inrate, the leading provider of ESG Ratings, is thrilled to announce...

BME launches IBEX ESG Index Family with Inrate’s Data

This morning, BME announced the launch of the IBEX ESG index family,...

Inrate Broadens Coverage and is Poised for Growth With New Global Reach

Inrate, the recognized Swiss-based leader and pioneer in...

Strategic Partnership With Minerva Analytics

Inrate, the independent Swiss sustainability research, ESG rating and...

SIX Debuts Swiss ESG Index Range

SIX has announced the launch of the first ESG indices for Swiss bond and equity...

FNG Recognition for Inrate’s UN Global Compact Assessment

Nasdaq launches New ESG Data Hub Alongside Industry Leaders

Nasdaq has recently announced its ESG Data Hub launch, which is set to connect...