Key Takeaways

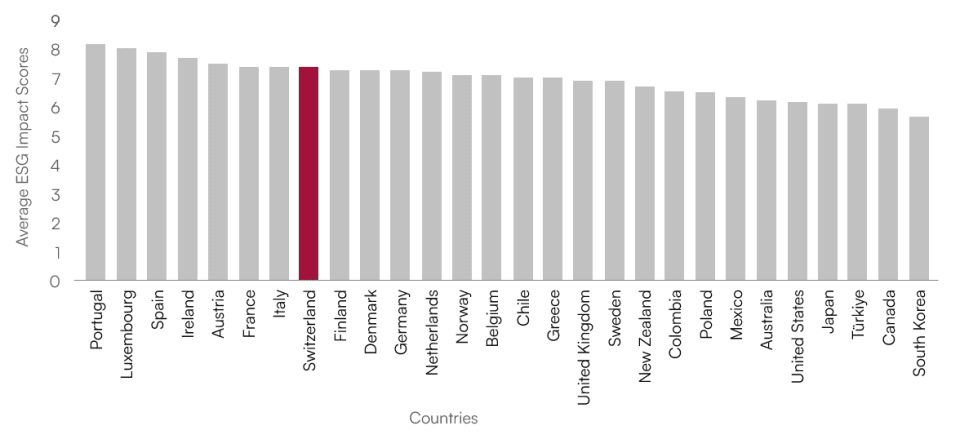

- Swiss companies rank 8th out of 28 OECD countries in overall ESG impact performance, placing them in the leading group.

- They outperform the OECD average in most sectors, particularly in Communication Services, Energy, and Materials, except for Real Estate, where they underperform.

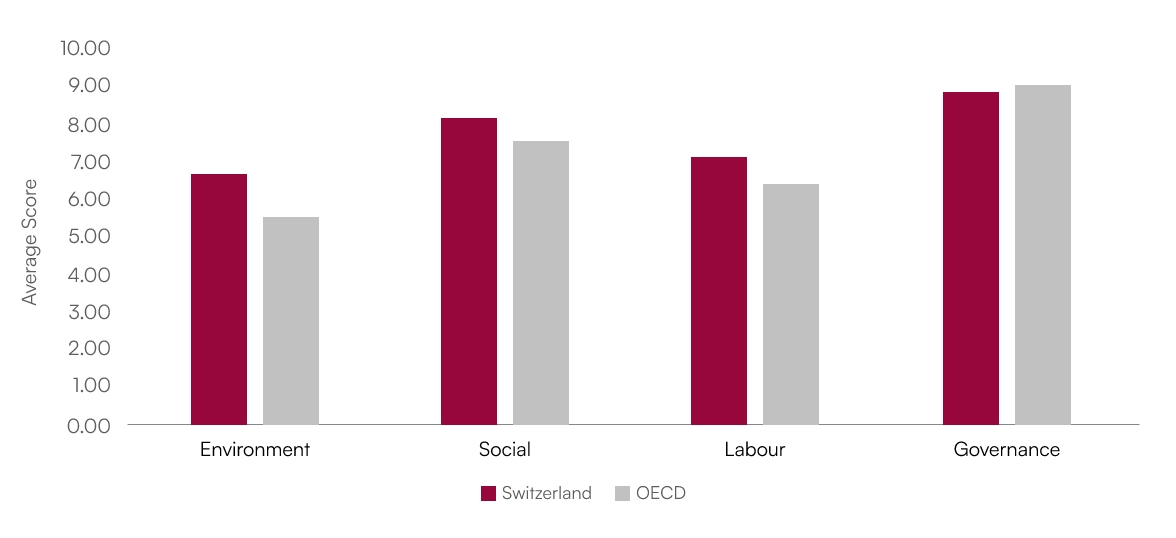

- By ESG dimension, Swiss companies do well in Environment, Social, and Labor metrics, but slightly underperform in Governance compared to their OECD peers.

Switzerland’s Sustainability Landscape: Leader, Laggard, or Something In Between?

Switzerland is a unique country in many respects—politically neutral, historically rich, economically prosperous, culturally diverse, and environmentally conscious. What else?

The country consistently ranks at the top in global indices for economic performance, happiness, and overall well-being. In fact, the IMF’s 2025 GDP per capita ranking places Switzerland third in the world, while the 2024 Gallup-sourced World Happiness Report ranks it ninth globally.1,2 In 2025, The Economist ranked Zurich and Geneva among the world’s ten most liveable cities, recognizing their exceptional stability, healthcare, infrastructure, and cultural environment.3

So, does this naturally make the Swiss corporate landscape a perfect fit for sustainability-led development, and position its companies as leaders in the field?

The reality is more nuanced. Many Swiss companies are large multinationals operating in a highly competitive global environment. As they expand and invest across borders, they often adapt to local business practices and pursue economically efficient models. From pharmaceuticals to finance, nutrition to technology, Swiss firms are industry leaders in various sectors. However, they also outsource a significant portion of their operations to countries with lower production costs and different living and employment standards.

Switzerland is also home to many small and medium-sized enterprises (SMEs). While some of these may be less internationally focused, their supply chains often involve international partners as well. This high degree of economic integration makes it difficult for Swiss companies to be complete outliers in the global sustainability landscape. In practice, they often align more closely with broader European or global trends.

So, How Do Swiss Companies Measure Up on Sustainability?

A reasonable approach is to compare Swiss companies to their peers in the Organisation for Economic Co-operation and Development (OECD)—a group of countries with similar levels of economic development, regulatory standards, and business environments. Looking at a group of 28 OECD countries, we find that Switzerland ranks 8th, with an average rating of 7.41. A score of 7.41 is equivalent to a grade of B-, making those companies likely investable in most indexes. ESG impact ratings are assessed on a scale of 1 to 12, with 12 (equivalent to a grade of A+) given to companies with the best ESG impact performance, and 1 (equivalent to a grade of D-) to those with the poorest performance.

Portugal and Luxembourg lead the group, while Canada and South Korea are at the opposite end of the spectrum.

Exhibit 1 ESG Impact Ratings across OECD Countries

Source: Inrate

Switzerland and OECD Countries: Are there Sector Weight Differences?

In the previous section, we looked at the overall ESG performance of Switzerland and its OECD peers. But a country’s economic structure significantly impacts its aggregate ESG profile. To understand this, we need to consider the relative importance of each sector.

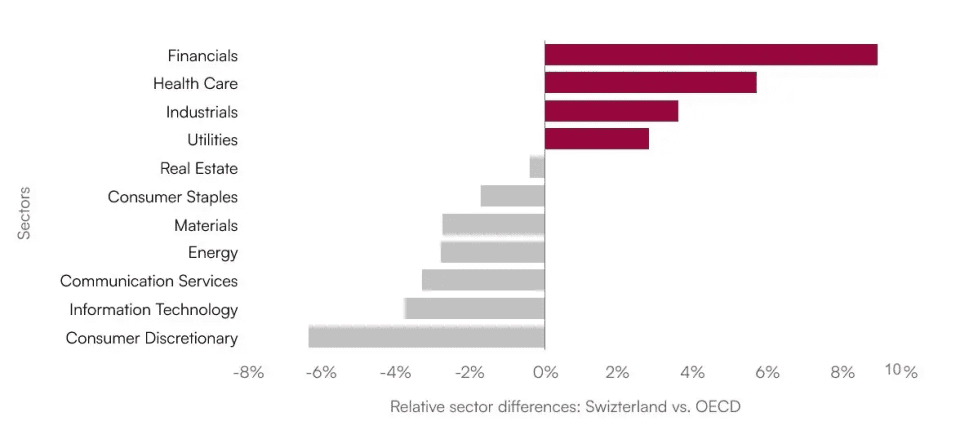

Rather than assessing market capitalization, we’ve opted for a straightforward approach: using the number of companies within each sector for both Switzerland and the broader OECD. For both Switzerland and the OECD group, we calculate the proportion of companies in each sector relative to the total number of companies in the respective universe. This allows us to clearly see where Switzerland’s business landscape differs. A positive difference means the sector is overrepresented in Switzerland, while a negative difference indicates it is underrepresented.

As shown in Exhibit 2, our findings largely confirm common perceptions: sectors like Financials, Healthcare, Industrials, and Utilities are more prominently represented in Switzerland than in the OECD average while Consumer Discretionary, Information Technology, and Communication Services are notably less prevalent.

Understanding these sectoral weight differences is crucial for financial institutions aiming to accurately assess national ESG profiles, manage portfolio exposure, and identify unique investment opportunities within Switzerland.

Exhibit 2: Sector Weight Differences between Switzerland and OECD

Source: Inrate

In Which Sectors Do Swiss Companies Lead?

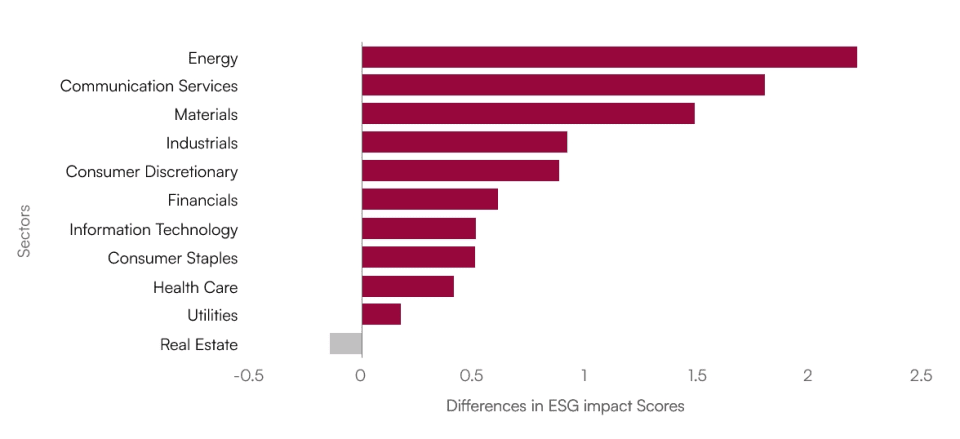

To provide the most accurate picture, we’ve controlled for any potential bias from varying sector sizes between Switzerland and the broader OECD group. Our sector-level analysis reveals where Swiss companies truly excel in ESG impact.

Swiss companies demonstrate stronger ESG impact performance in nearly every sector compared to the OECD average. This outperformance is particularly pronounced in key sectors such as Energy, Communications Services, and Materials. In contrast, the gap narrows significantly in Healthcare and Utilities. Notably, Real Estate is the only sector where Swiss companies fall just below the OECD average in terms of ESG impact performance.

This overperformance may be partly attributed to Switzerland’s high economic development, but more directly to its strong national commitment to sustainability. Supporting this, the 2024 Environmental Performance Index by Yale ranks Switzerland 9th globally, reflecting its robust environmental governance. 4 Additionally, a recent study by Swiss Sustainable Finance highlights a 13% increase in sustainability-related investments in 2024, underscoring sustained market demand for ESG performance. 5 The trend may also be reinforced by heightened regulatory expectations and greater public scrutiny in sectors like Energy and Industrials, where visibility and impact are more pronounced.

Exhibit 3 Differences in ESG Impact Ratings between Swiss and OECD Companies

Source: Inrate

Comparing the Environmental, Social, Governance, and Labor Dimensions

Final step: in which areas do Swiss companies lead? Out of the four considered areas, Swiss companies lead in three: Environment, Social, and Labor. Only Governance is slightly below par when comparing Swiss to OECD companies.

Exhibit 4 Environmental, Social, Governance, and Labor Dimensions Differences

Source: Inrate

Conclusion

First, Swiss companies are in the lead group among OECD countries when it comes to ESG impact performance, ranking eighth in an examined group of 28 OECD countries.Next, this overperformance is present in almost all sectors except for Real Estate, where Swiss companies perform below the OECD averages. The overperformance is more marked in the Communications Services, Energy, and Materials sectors. Finally, considering the ESG dimensions separately, Swiss companies outperform their OECD peers in Environment, Social, and Labor, but slightly underperform in the Governance dimension.

Contributor

Aymen Karoui

Head of Methodology

Sources

- International Monetary Fund (IMF) – World Economic Outlook: GDP per Capita (Current USD).

- CountryEconomy.com – World Happiness Index: Switzerland.

- The Economist – The World’s Most Liveable Cities in 2025. Published June 16, 2025.

- Yale Center for Environmental Law & Policy – 2024 Environmental Performance Index (EPI).

- Swiss Sustainable Finance (SSF) – Swiss Sustainable Investment Market Study 2025.