Introduction

The regulatory landscape for sustainable finance is rapidly evolving to address investors’ growing concerns around transparency, reliability, and quality of ESG ratings. ESG Rating Providers (ERPs) are at the forefront of this shift, with their ratings influencing market transparency and affecting investment decisions. This blog gives an overview of what regional regulations are expecting of rating providers, with a particular focus on the EU and the UK and gives insight into how investors can expect the landscape of ESG ratings to shift as a result of these regulations.

Overview of the ESG Ratings Landscape

ERPs, which play a critical role in shaping investment decisions and market transparency, are increasingly coming under regulatory purview. Globally, several jurisdictions are moving forward with regulations for ERPs. The International Organization of Securities Commissions (IOSCO) is a global association of securities regulators. Its recommendations on ESG ratings and data products serve as a foundational framework for various jurisdictions, including the EU and the UK, in developing their regulatory frameworks for ERPs.

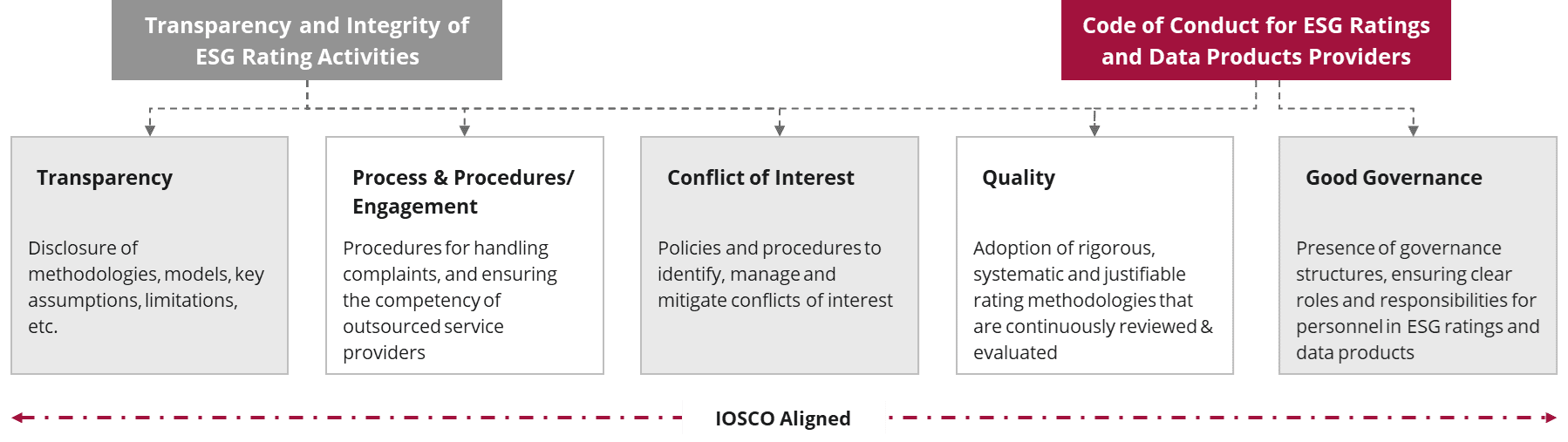

In the EU, the European Securities and Markets Authority (ESMA) has introduced a regulation to enhance transparency and integrity of ESG rating activities.

Meanwhile, in the UK, the International Capital Market Association (ICMA) and the International Regulatory Strategy Group (IRSG) have introduced a Code of Conduct for ESG ratings or data products providers.

In India, the Securities and Exchange Board of India (SEBI) has introduced a framework for ERPs.

Japan’s Financial Services Agency (FSA) has also issued a ‘Code of Conduct for ESG Evaluation and Data Providers’.

Various jurisdictions present slight variations in their regulatory requirements, all of which are equally important; however, the regulatory developments in the EU and the UK hold primary significance due to Inrate’s geographical focus.

Read more: ESG Risk Ratings vs ESG Impact Ratings

1 Regional Regulatory Developments – A Focus on the EU and the UK

1.1 Regulatory frameworks in the EU and the UK

EU: Transparency and Integrity of ESG Rating Activities

ESMA has taken the lead in regulating ERPs within the EU. It has introduced a regulatory framework that aims to enhance the transparency, reliability, and comparability of ESG ratings. This framework includes several key aspects, such as registration requirements, which mandate ERPs operating in the EU to register with ESMA and adhere to specific registration requirements. Additionally, providers are required to disclose information related to key areas, including transparency, conflict of interest, processes & procedures, and quality. Furthermore, ESMA monitors the performance of ERPs and may take enforcement action when deemed necessary.

UK: Code of Conduct for ESG Ratings and Data Products Providers

In the UK, ICMA and IRSG outlined a voluntary Code of Conduct, comprising six principles, emphasizing good governance, quality, conflicts of interest, transparency, confidentiality, and engagement. Upon signing the Code of Conduct through ICMA, ESG ratings and data providers are required to implement their provisions. After implementation, they must publish a ‘Statement of Application’ on their website, notifying ICMA with the pertinent details. The Code is designed to be closely aligned with IOSCO’s recommendations, aiming for international interoperability.

1.2 Focus area of the regulations

Although both the EU and the UK regulations are largely aligned, there are some differences in their scope, particularly regarding governance, applicability to data products, and other related areas. While these regulations directly target ERPs, they are designed to enhance the overall credibility and integrity of the ESG ratings market, ensuring that investors can rely on high-quality, transparent assessments.

1.3 Deep dive into the EU’s regulation and how it impacts investors

With the recent publishing of the EU’s regulation on the transparency and integrity of ESG rating activities, it is important to deep dive into how the regulation is expected to change the ESG ratings landscape for investors:

1) Transparent disclosure of rating methodologies: Investors and companies will have access to clear information on how ratings are calculated including the assumptions used, data sources, and the weightage of E, S, and G factors. You can read more about Inrate’s rating methodology here.

2) Clearly defined assessment approach: Investors will have a clear indication on whether the rating focuses on financial risks, societal impacts, or both (i.e., distinguish between ESG risk ratings, ESG impact ratings, and ESG ratings that focus on double materiality).

3) Increased confidence in conflict-of-interest management: The regulation requires rating providers to separate rating activities from consulting, auditing, or credit rating services. This helps reduce investor concerns around conflicts of interest, impacting the reliability of the ratings.

4) Supervision by ESMA: The ESMA will authorize, enforce, and monitor compliance and will impose penalties for non-adherence. This will help increase accountability among rating providers and improve reliability of ratings.

5) Greenwashing prevention: The regulation’s focus on transparency across the board supports investors to avoid any misleading sustainability claims.

6) Trickle-down effect on data quality from ESG Data Providers: The investors purchasing ESG data solutions from rating providers can expect an improvement in the data transparency and quality of the data solutions that they are currently receiving.

2 Inrate’s Approach to Transparency, Accuracy, and Quality

Inrate understands the implications of the new regulatory requirements for ERPs and is naturally positioned to be fully compliant. Our ratings have always been underpinned by a focus on transparency, recency, and quality, which aligns seamlessly with the expectations laid out by regional regulations. Some actions that underpin our preparedness include:

• Transparency: Inrate currently offers separate aspect scores and grades. We have already published a preliminary outline of our methodology, available here, which is to update in line with the expectations of the regulations.

• Conflict-of-Interest Management: Inrate has procedures for employee independence and does not participate in any consulting, auditing, or credit rating services.

• Quality: Inrate has always assessed alignment with international agreements, and will continue to do so, as recommended by the EU’s regulation.

• Governance: Inrate has clear governance structures in place and will be ensuring documentation aligns with the principles in the Code of Conduct.

As an active participant and member of the European Association of Sustainability Rating Agencies (EASRA), Inrate gains insights into emerging regulations for ERPs in the European region and Swiss jurisdiction, while continuously monitoring updates to align its practices with evolving compliance requirements.

Conclusion

Global regulations aimed at increasing transparency, reliability, and quality of ESG Ratings will enable investors to make more confident sustainable investment decisions. Such regulations are key to ensuring traceability and comparability in the market, enabling investors to choose ratings that best suit their purposes.

Contributors

Pallavi Singh

Head of Products

Mridul Mitra

Senior ESG Product Analyst