Public and Private Companies: A Background

Whether to remain privately owned or become a publicly traded company has long been a key question for corporate managers and investors.

Proponents of the public model emphasize its numerous advantages, including increased visibility, access to a larger pool of investors, greater transparency, lower financing costs, and improved reporting and accounting standards.

However, critics of the public model point to the significant costs associated with going public, which often make it more suitable for large, international companies. They also highlight the drawbacks of being under constant market and investor scrutiny, which can encourage short-term decision-making at the expense of long-term strategy. Moreover, public companies must comply with extensive regulatory and governance requirements that can slow down their decision-making processes.

The Rise of Private Financing

After several decades of growth in the number of listed companies during the 1990s, this trend appears to have reversed. A study by McKinsey & Company highlights this shift, showing that the number of listed firms in the United States declined from approximately 5,500 in 2000 to about 4,000 in 2020. i This suggests that going public is no longer the ultimate goal for many companies.

In the debt market, a notable development has been the rise of non-bank financing, commonly referred to as private credit. Globally, the private credit market has quadrupled over the past decade, reaching approximately US$2.1 trillion in 2023.ii Here too, it appears that traditional financial markets and institutions are no longer the sole providers of capital. Companies are increasingly turning to alternative sources of financing to diversify their funding portfolios, lower borrowing costs, and mitigate risk.

Public vs. Private Companies: Implications for ESG Impact

As mentioned earlier, public companies are generally larger and disclose more information, which often translates into higher ESG ratings. Regulatory requirements and shareholder activism further reinforce the expectation that public companies should demonstrate strong ESG performance.

Nonetheless, some private companies may benefit from greater agility in decision-making, allowing them to achieve better alignment with ESG goals. They can also implement transition plans more quickly and take the lead on voluntary ESG initiatives. Know more about Inrate’s approach for evaluating ESG Impact of Private Companies

Public vs. Private Companies ESG performance: An Empirical Analysis

Ultimately, whether public or private companies exhibit better ESG performance is an empirical question. We analyze a global sample of 150 private companies and a matched sample of 150 public companies, with matches based on sector, country, and revenue. Controlling for these factors helps mitigate differences arising from variations in financial resources, legal environments, and sector-specific practices and requirements.

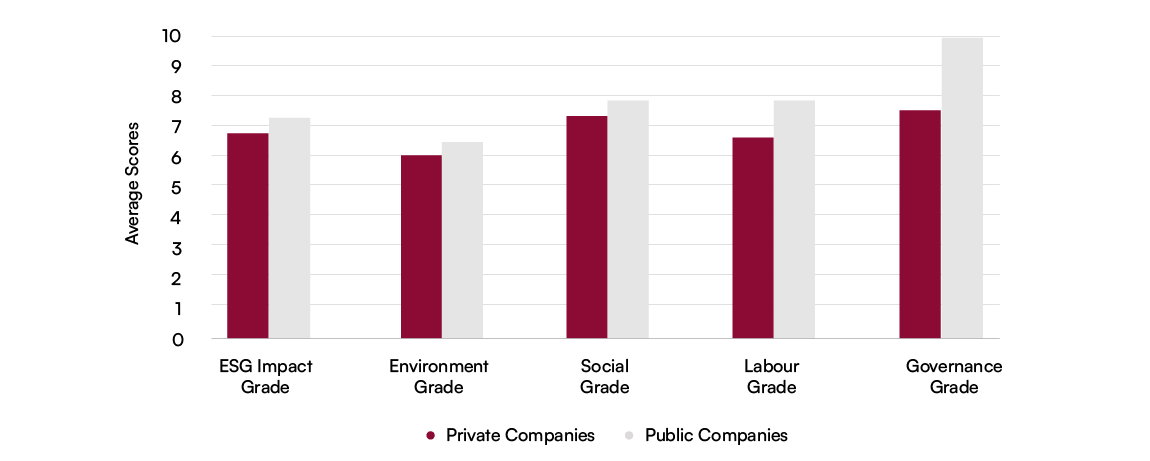

Figure 1 presents a side-by-side comparison of ESG ratings for public and private companies. Overall, public companies outperform private companies in both the overall ESG score and the individual pillars. The most pronounced differences are observed in Labor and Governance, whereas Environmental performance is nearly equivalent between the two groups.

Figure 1 Public and Private Companies’ ESG Impact Performance

Source: Inrate

Our findings are consistent with previous studies comparing public and private companies. For instance, a 2022 Boston Consulting Group (BCG) study found that private companies generally lag behind their public counterparts, particularly on certain ESG indicators such as renewable energy adoption.iii

Environmental, Social and Governance Indicators

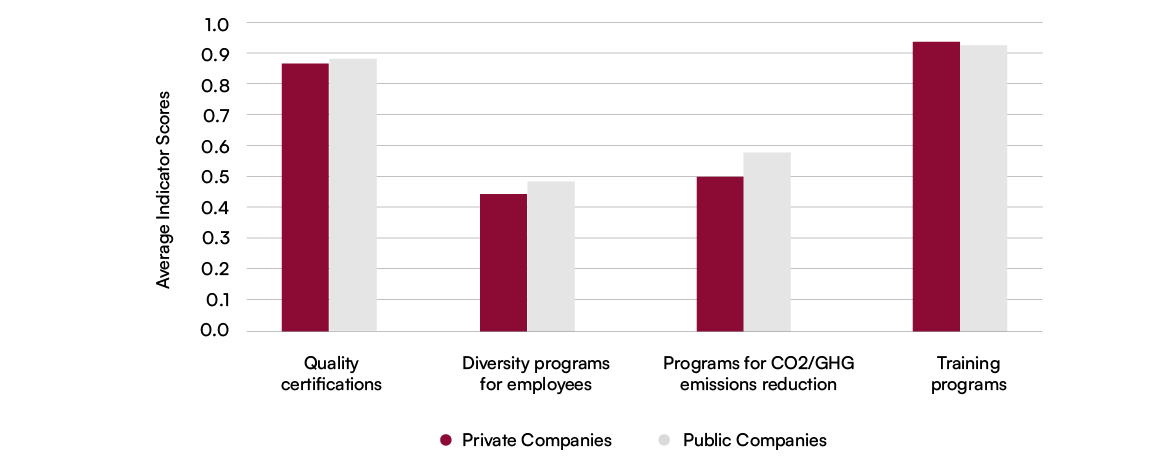

Examining selected ESG indicators in more detail, Figure 2 generally confirms previous evidence that public companies outperform their private peers, although the magnitude of the difference varies across indicators. The scores range from 0 to 1, where 0 represents the poorest ESG impact and 1 represents the best.

Figure 2 Public and Private Companies for Selected Indicators

Source: Inrate

Key Takeaways for Practitioners and Private Equity Managers

Public and private companies operate in distinct yet increasingly interconnected environments. Public companies typically face stronger regulatory oversight, disclosure requirements, and market scrutiny, which promote greater transparency and accountability. In contrast, private companies often enjoy greater flexibility, longer-term strategic horizons, and reduced immediate pressure from shareholders, though they also face challenges related to data availability, comparability, and visibility.

Consistent with these considerations, our analysis shows that public companies generally achieve higher ESG impact ratings than their private peers. This outperformance is observed across all ESG pillars, with the largest differences in Labor and Governance.

Our findings are particularly relevant for private equity and alternative investors. While private companies’ overall ESG performance tends to be lower, the gap with public companies is moderate, suggesting meaningful opportunities for improvement. Assessing the ESG performance of private companies can provide valuable insights and help unlock their full potential.

Contributor

Aymen Karoui

Head of Methodology