ESG Ratings and the Emerging Role of Transition Rates

A recent PwC study projects that investments incorporating ESG considerations are expected to reach US $145.4 trillion by 2025. i This surge underscores how rapidly ESG ratings have evolved into a cornerstone of modern investment strategies. As sustainability considerations continue to gain prominence, portfolio managers are increasingly relying on ESG metrics to guide investment integration, screening, benchmarking, and reporting.

Yet, while the use of ESG data and ratings continues to expand across markets, several promising analytical applications remain underexplored. One such concept is transition rates—not to be confused with transition risk ratings, which evaluate a company’s preparedness for a low-carbon economy.

Transition rates, a concept widely used in credit rating methodologies, measure the probability of a company moving from one rating grade or category to another over a given period. When applied to ESG ratings, this approach could yield valuable insights into rating dynamics and performance trajectories, providing portfolio managers with an additional layer of information when, for example, defining inclusion or exclusion criteria based on ESG impact ratings.

This blog explores the relevance of transition rates using Inrate’s ESG Impact rating framework and discusses practical implications for investors seeking to better understand rating movements and enhance portfolio decision-making.

Read more: Inrate’s ESG Rating methodology

Transition Rates in Credit Ratings

The credit migration matrix is a well-established analytical tool used to illustrate the likelihood of a company being upgraded, downgraded, or maintaining its current credit rating over a given period. Major credit rating agencies regularly publish these matrices, and they serve several important purposes, including:

- Providing predictive insights into future financing costs and the probability of potential credit events, such as defaults or bankruptcies.

- Guiding investors in assessing shifts in credit quality, which is particularly valuable for active fixed-income strategies.

- Supporting the categorization and risk assessment of fixed-income instruments within portfolios.

- Assisting corporate planning efforts, particularly in budgeting, capital structure management, and risk mitigation.

In essence, credit migration matrices offer forward-looking intelligence that enhances decision-making for a wide range of market participants—from investors and analysts to corporate treasurers and risk managers.ii

Why the Use of ESG Migration Matrices Has Been Limited So Far?

Despite their potential, ESG migration matrices have not yet achieved widespread adoption. As ESG ratings are a relatively recent development, much of the industry’s attention is still focused on regulatory alignment, data standardization, and methodological refinement. While the limited availability of historical ESG data and the high variability across time present challenges for producing robust transition estimates, ongoing improvements in data coverage and analytical approaches are paving the way for more reliable and insightful ESG transition analysis in the near future.

The Value of ESG Transition Rates

As ESG frameworks continue to mature, transition matrices have the potential to become powerful analytical tools—much like their role in credit analysis. They can provide:

- Forward-looking insights to support ESG investment decision-making.

- ESG Volatility tool for assessing rating changes and overall stability

- Stock selection, such as identifying companies that may be excluded from—or rejoin—sustainability indices.

Transition Rates Across ESG Impact Categories: An Illustrative Example

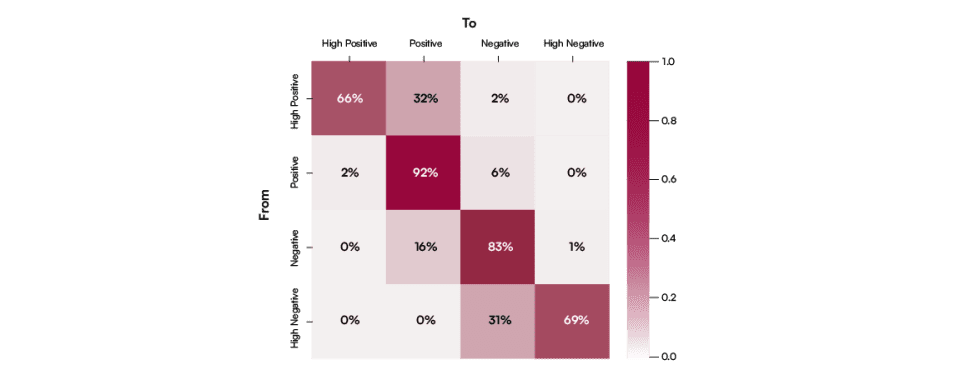

We provide a transition matrix across categories. Inrate classifies ESG Impact ratings into four distinct impact categories: High Positive, Positive, Negative, and High Negative. Exhibit 1 presents the category transition matrix i.e. the relative probabilities of moving from one category to another. The probabilities were calculated using a global sample of companies over the years 2003 and 2004.

Overall, the figure shows a high level of consistency across years. The probability of remaining in the same category is higher than that of moving to a better or worse category. Moreover, it is rare to observe companies improving or deteriorating by two categories at once. Significant downgrades are generally driven by major controversies, whereas upgrades often reflect expansion into more sustainable activities. Lastly, the probabilities of remaining in the same category are higher for the middle categories i.e. Positive and Negative than for the extreme categories i.e. High Positive or High Negative.

Exhibit 1 Inrate’s ESG Impact Transition Rates across Categories

Source : Inrate

The Importance of Early Signals in ESG Analysis

Many ESG assessment tools are designed to provide forward-looking insights by integrating both current and anticipated information—such as a company’s alignment with climate pathways, the adoption of sustainability policies, and decisions related to reducing emissions or water consumption. These factors can have both immediate and long-term effects on corporate performance.

The early-warning nature of such information, combined with its timely dissemination, enhances the value of ESG tools for portfolio managers and investors. By offering a structured view of potential future developments, transition matrices can help support more informed, proactive, and resilient investment decisions.

Opportunities and Use Cases for Asset Managers

Asset managers are continually seeking reliable signals to anticipate market movements and corporate transitions. ESG transition matrices provide a systematic and predictive framework for evaluating sustainability performance over time. By quantifying rating dynamics, these tools can strengthen risk management, improve portfolio alignment, and advance long-term ESG objectives.

As methodologies evolve and data availability improves, the integration of transition rates into ESG analysis is likely to become a core component of the modern investment toolkit, enhancing both transparency and strategic decision-making.

Read more: How Inrate creates value for Asset Managers

Contributor

Aymen Karoui

Head of Methodology