Discover comparable and science-based ESG ratings that align with evolving sustainability goals. Based on extensive research, our ESG ratings provide insights into the ecological and social impact and governance policies and practices of investments across asset classes.

Discovering Impact Through Our ESG Ratings

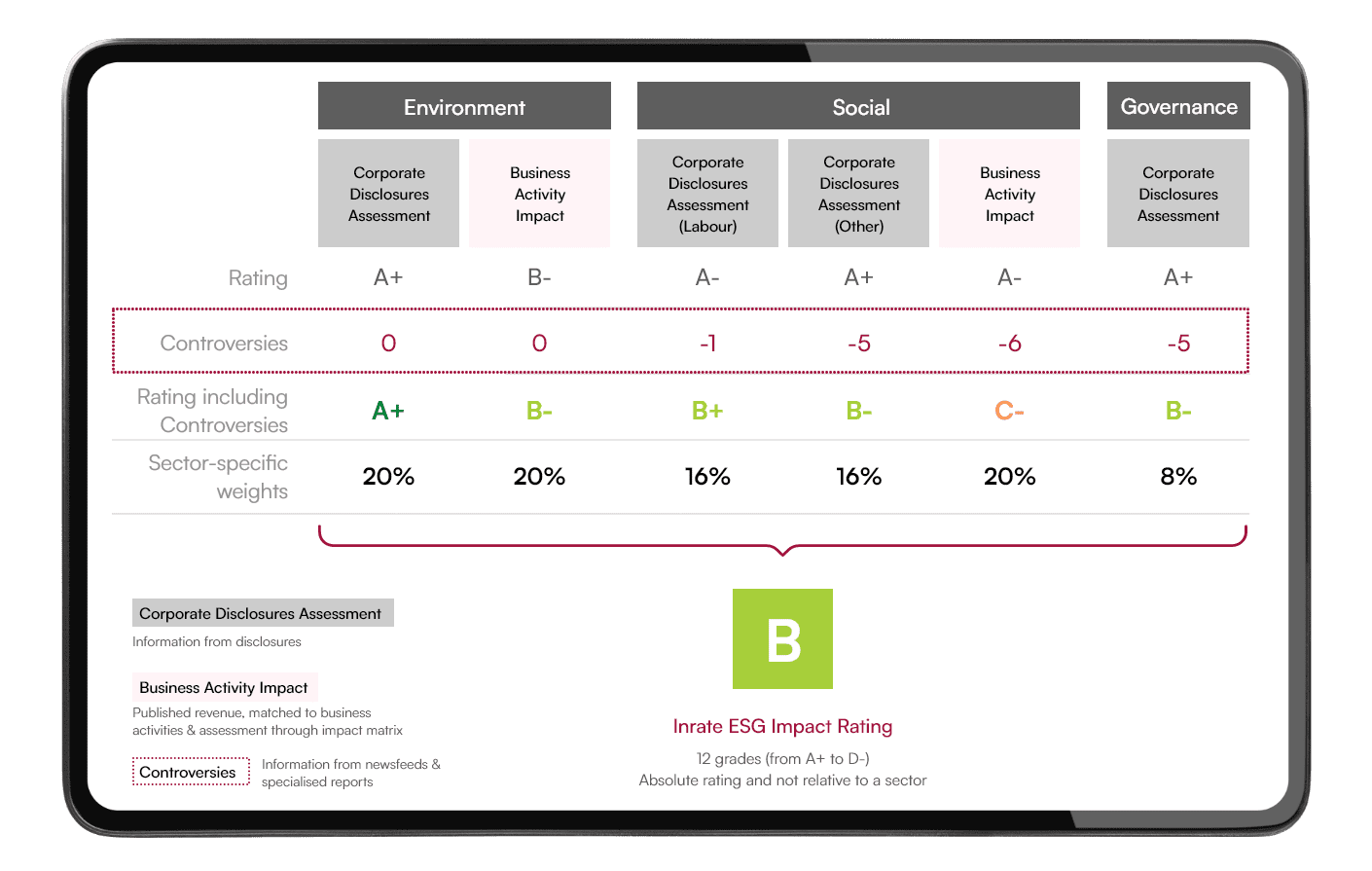

Inrate’s ESG ratings stand out with its unique methodology that includes a unique business activity assessment model, granular assessments using disclosures, and a detailed impact-oriented controversy analysis.

Overall Impact Rating of a Company

Absolute and comparable ratings using a letter scale

Features of ESG Ratings

Our Offerings

Why Inrate

Impact Lens

Inrate has balanced financial materiality with impact well before 'double materiality' gained prominence in European Capital Markets. The impact of a company's business activities has stood at the core of Inrate's assessments, overcoming the biases created by disclosures.

Flexible Data Models

Inrate’s research can be customised to develop comprehensive datasets based on the client’s investment objectives and evolving regulatory requirements. This unmatched customisation utilises meticulous research on the impact of business activities, corporate sustainability disclosures, and ESG controversies.

Dedicated Client Support

Inrate operates as a ‘glass box’ with an unparalleled commitment to transparency and communication. We deliver unequivocal support from our long-standing team of research analysts, providing insights from our extensive research and subject matter expertise.

Regulatory Alignments

Inrate’s data lake evolves in tandem with new regulatory frameworks, consistently empowering clients to uncover their portfolio’s regulatory conformity. Our datasets promise relevance and materiality with the evolving sustainability market.