Introduction

Financial institutions often grapple with the challenge of financing industries that are essential to the economy but are hindered by significant ESG transition barriers. Hard-to-abate sectors, such as steel, cement, chemicals, aviation, and shipping, as well as industries with complex social and governance risks, such as labor-intensive manufacturing, require targeted strategies to improve ethical practices, advance social equity, and ensure regulatory compliance. The transition in these sectors is complicated by infrastructure lock-in, technological limitations, global supply chain dependencies, and high capital costs.

This is where transition finance becomes essential. By providing capital to support credible, science-based decarbonization efforts and broader ESG improvements, financial institutions can play a pivotal role in driving meaningful progress while managing risks and identifying investment opportunities. Whether addressing climate impact, social responsibility, or governance transparency, transition finance offers a pathway to support industries as they evolve toward more sustainable practices.

This blog explores key metrics, frameworks, and strategies through which financial institutions can assess a company’s transition progress. These data-driven insights help understand transition dynamics at both macro and company-specific levels, empowering investors and stakeholders to make well-informed decisions.

How to Evaluate Transitionary Trends?

Sustainable transition can be assessed by analyzing various elements. At Inrate, we look at four key themes—sustainable development, a low-carbon economy, restoring biodiversity, and an inclusive society. These themes provide a structured approach to evaluating Environmental, Social, and Governance (ESG) impact, guiding methodologies and assessment frameworks.

Macro Perspective: Rethinking Sector Classification for Sustainable Transition

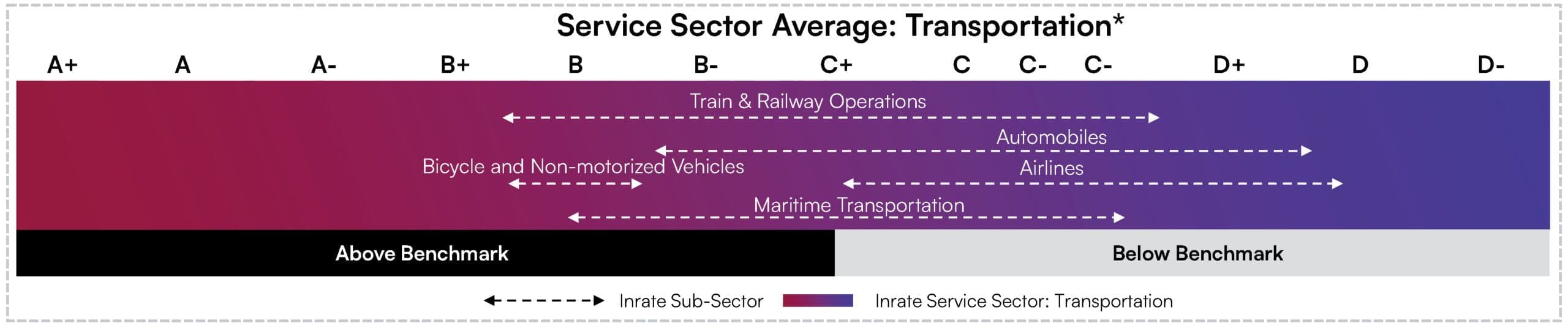

From a macro perspective, sustainable transition requires a fundamental restructuring of the economy over the long term. This shift may favor certain industries over others based on their contribution to essential societal needs. Instead of relying on traditional industry classifications, sectors can alternatively be defined by the key services they provide. For example, rather than segregating air, sea, private, and rail transport, they can be grouped under the broader transportation sector, reflecting their shared role in enabling mobility for people and goods. This perspective allows investors to evaluate economic activities based on their societal function, offering a more structured approach to capital allocation that prioritizes solutions driving sustainable impact.

Since the Inrate ESG Impact Ratings applies an absolute measurement—assessing the environmental and social impact of an activity regardless of its industry—companies across different sectors can be compared directly. This means that airlines can be evaluated alongside rail companies, and shipping firms can be assessed against car manufacturers. Inrate refers to this as the best-in-service approach, which identifies companies within a sector that fulfill a societal need with the least negative externalities.

The chart above illustrates how different subsectors within transportation perform in the Inrate Impact Rating. Some subsectors, such as train and railway operations and automobiles, show a wide range of ratings. This variation can be attributed to multiple factors. Firstly, companies within the same subsector may have diverse activities—for instance, a car manufacturer may also be involved in aerospace propulsion, or a railway operator may generate revenue from real estate or hospitality services. Secondly, the ratings incorporate not only a company’s core activities but also its management practices, and controversies, leading to further differentiation even among companies with similar business models.

Despite this variability, certain patterns emerge. Airlines tend to score lower than rail transportation companies, primarily due to their high Greenhouse Gas (GHG) emission, noise pollution, and air quality impacts on local populations. In the automobile subsector, the rating spectrum is particularly broad as vehicle impact varies significantly depending on factors such as fuel type, vehicle size, and emission levels.

A meaningful transition within the transportation sector would require a shift toward lower-emission modes of transport—reducing the reliance on air travel while expanding rail networks. In the automotive industry, the transition would favor smaller electric vehicles over large SUVs for personal transport. The best-in-service approach allows investors to exclude companies that fall below a sector-specific threshold. In the chart, this threshold is set at C+ (the sector average), meaning that all airlines would be excluded, only the highest-rated automobile companies would be included, and most train and railway operators would meet the criteria.

This approach provides investors with a clear, impact-driven methodology for aligning capital with sustainable transition goals while identifying companies that deliver essential services with the least environmental and social harm.

Micro Perspective: Evaluating Transition at the Company Level

For investors seeking a more immediate impact, assessing transition at the micro level provides a focused approach. Rather than analyzing entire sectors, this perspective focuses on individual companies, evaluating their products, services, and operational practices to determine sustainability performance. Investors can prioritize companies that produce goods and services in the most sustainable way while excluding those that rely on unsustainable methods.

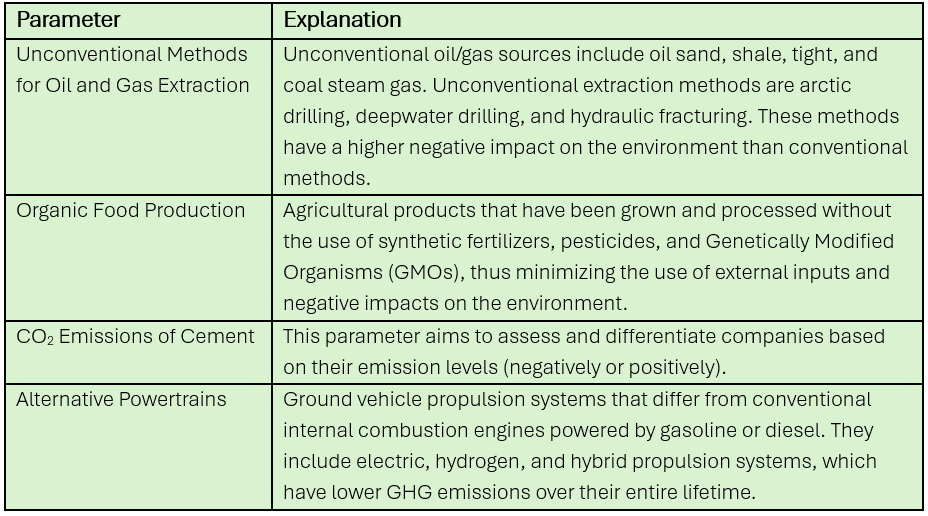

For example, in the energy sector, oil and gas companies may use conventional extraction methods or more environmentally harmful techniques such as fracking and deep-sea drilling. In the transportation sector, automakers can either prioritize electric vehicles and smaller, low-emission cars or continue producing high-emission vehicles.

A company’s transition efforts can be assessed more precisely through specific parameters that refine how business activities are evaluated. These parameters highlight variations in execution that influence a company’s environmental and social impact score. For instance, an oil and gas company using unconventional extraction methods may receive a lower environmental score, while an automaker producing a high share of electric vehicles or maintaining low fleet-wide CO₂ emissions will receive a higher score.

Investors can apply this approach by excluding companies with negative parameters, such as those engaged in fracking or deep-sea drilling, and prioritizing companies with positive parameters, such as automakers with lower average CO₂ emissions. This granular perspective enables investors to allocate capital toward businesses that demonstrate tangible progress in their sustainable transition.

Read more: Difference Between ESG and Impact Investing

A look into certain parameters

Tracking Change Over Time: Measuring a Company’s True Sustainable Transition

A third approach is to assess whether a company is genuinely transforming over time. Many companies claim to be in transition, but without concrete action, these commitments remain superficial. By analyzing a company’s business activities over time, investors can determine whether meaningful progress is being made.

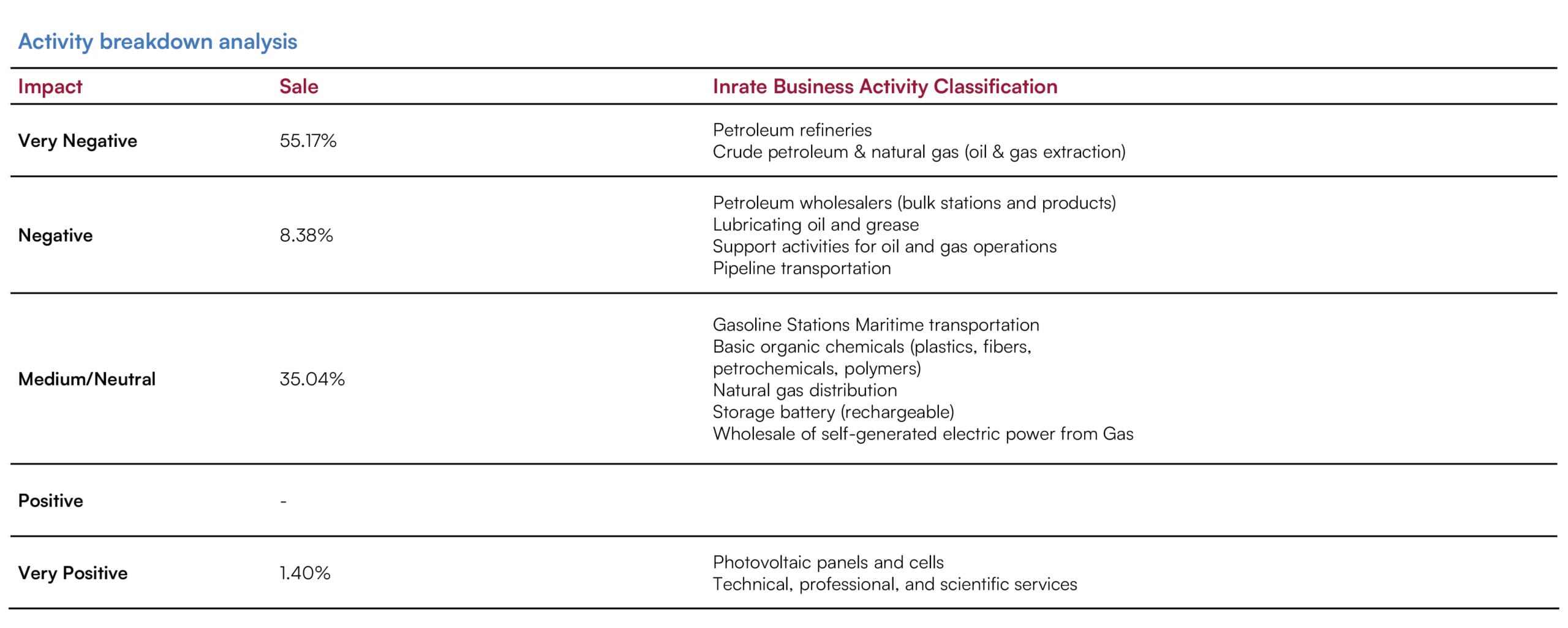

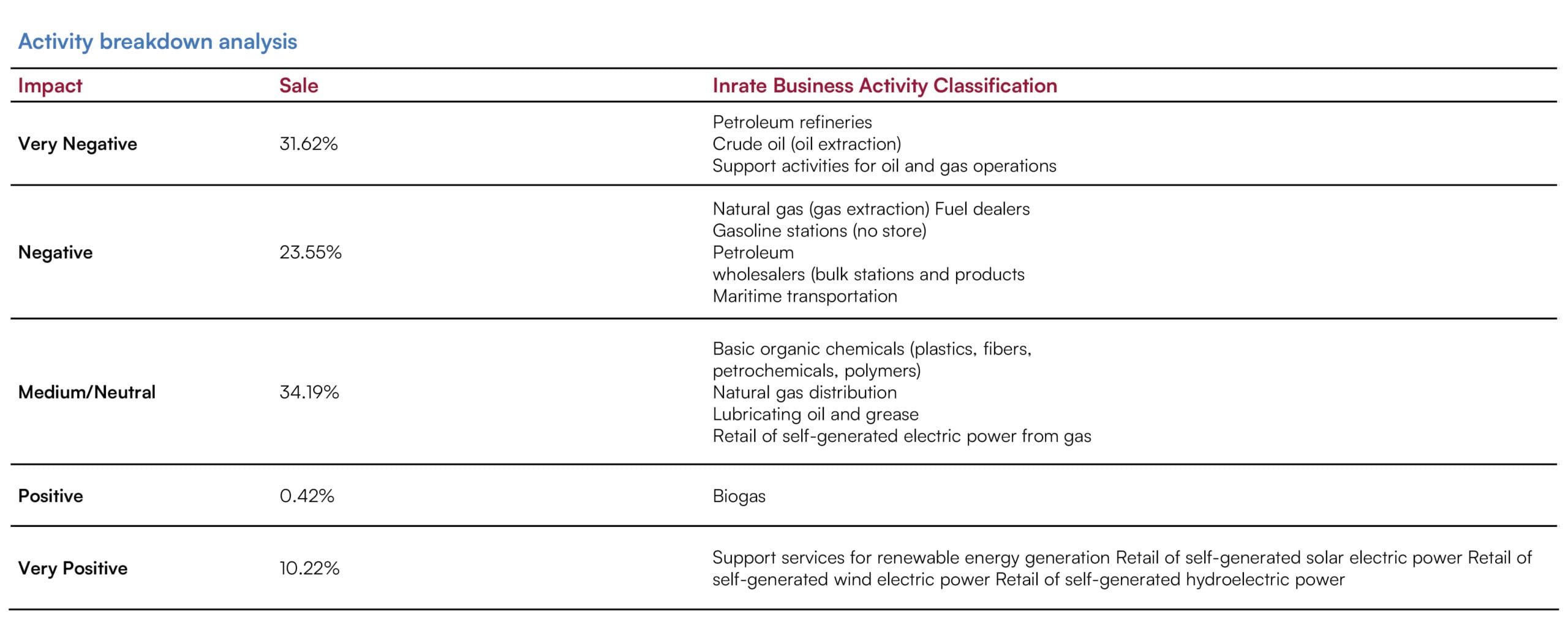

For example, a fossil fuels company may announce investments in renewables, but if most of its capital continues to flow into fossil fuel projects, no real transition is occurring. The only way to gauge the sincerity of a company’s commitment is by examining actual shifts in its revenue streams and investment priorities over time.

The graph below illustrates this concept with two fossil fuel companies in 2017 (top) and 2023 (bottom). One company significantly increased its share of revenue from renewables—from about 1% to over 10%—while the other showed only negligible change. This comparison highlights the importance of tracking real, measurable shifts rather than relying on stated ambitions.

By adopting this longitudinal approach, investors can distinguish between companies making tangible progress toward sustainability and those that are merely signaling transition without meaningful action.

Energy Company A

2017:

2023:

Driving Meaningful Sustainability Transitions

Achieving sustainable transition is a complex but essential process, requiring a multi-dimensional approach comprising:

1. Macro Perspective: The best-in-service approach redefines sector classification based on societal needs, identifying companies that deliver essential services with the least environmental and social harm.

2. Micro Perspective: Granular parameters distinguish how companies operate within their sectors—whether an automaker prioritizes low-emission vehicles, or an energy company relies on cleaner extraction methods.

3. Change Over Time: True transition is measured by tangible shifts in business activities and revenue streams, separating companies that act from those that merely signal intent.

By leveraging these perspectives, investors can cut through greenwashing and allocate capital to companies, driving real, measurable progress. A data-driven approach ensures that sustainability assessments are not just about commitments but about tangible action and impact.

Contributor:

Matthias Schmid

ESG Analyst