Since the end of 2024, tariffs have taken center stage in the economic agendas of nearly all countries worldwide. As the U.S. has implemented tariffs on almost all its major trading partners, market participants are bracing for substantial repercussions on financial markets and economies.

Major U.S. indices have declined on a year-to-date basis, with the S&P 500 down 8.04% and the Dow Jones down 4.36% as of April 4, 2025. The prospects of a global recession are no longer ruled out by economists and financial strategists.

Some analysts have described the current implementation of tariffs as one of the most significant economic events in recent times. These tariffs could have a profound impact on sustainability, further disrupting the transition toward net-zero emissions and global temperature alignment.

Sustainability Impact of Tariffs

On the positive side, imposing tariffs may reduce international trade, in theory, lowering international transport and its associated CO2 emissions. Additionally, higher tariffs could encourage consumers to buy local products rather than imports, reducing supply chain risks and improving product traceability. Another potential benefit is that higher prices on certain polluting goods may lower their consumption.

On the flip side, tariffs are likely to disrupt the principles of free trade, which rely heavily on Ricardo’s theory of comparative advantage. As countries diversify their production instead of specializing in goods for which they have a comparative advantage, they may end up producing many goods at a higher cost than if they had imported them. This loss of efficiency could also translate to increased energy consumption, ultimately harming corporate sustainability efforts.

Furthermore, as the U.S. relocates many energy-intensive industries domestically, it may become more reliant on fossil-fuel energy and less on clean energy, leading to higher emissions.

Read more: What is an ESG Score?

Social and Economic Consequences

On the social and governance fronts, the sudden increase in tariffs may pose challenges related to working conditions, competitiveness, and technological development, reducing capital and technology mobility and slowing economic growth.

One example is the disruption of supply chains in the automotive industry between the U.S., Canada, and Mexico. U.S. automakers have built an extensive network of suppliers, which will be difficult to replace, requiring a complete rethinking of the value chain. Additionally, some raw materials and expertise, including innovative green solutions, may not be readily available in the U.S.

While relocating industries may create jobs in certain sectors, it could also harm companies that rely on exports.

Long-term Outlook

In the long run, trade barriers are anticipated to reduce economic productivity and hinder wealth creation. This decline in living standards may, in turn, lead to lower well-being indicators at the national level and diminished sustainability efforts among corporations.

Another concern is that as countries become less economically integrated, they may develop more fragmented sustainability frameworks, potentially hindering the global transition toward a more sustainable world.

Overall, tariffs are likely to disrupt economies and increase uncertainty in financial markets. These issues are expected to shift attention toward more immediate concerns, such as supporting companies impacted by tariffs, adjusting monetary policies, and implementing countermeasures. As a result, sustainability-related issues may take a backseat.

Source: Inrate

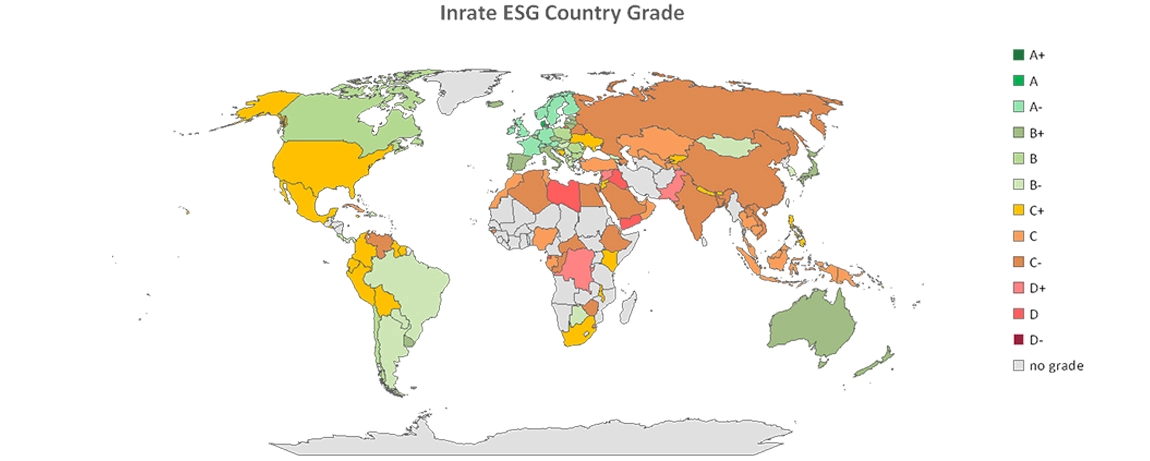

Figure 1 depicts the Inrate Country Ratings worldwide as of 2024, highlighting substantial disparities between countries. Continental Europe, Australia, and Canada currently display the highest ESG grades. It will be interesting to observe how these ratings evolve following the implementation of tariffs and counter-tariffs.

FAQs - Sustainability Impact of Tariffs

1. How do U.S. tariffs impact global sustainability efforts?

U.S. tariffs can disrupt global supply chains, increase production inefficiencies, and slow progress toward net-zero goals. While reduced trade may lower transport emissions, higher domestic energy use can ultimately raise overall emissions.

2. Can tariffs support environmental sustainability in any way?

In theory, tariffs may encourage local production, improve supply chain traceability, and reduce emissions from international transport. However, these benefits are often offset by higher energy intensity, reduced efficiency, and reliance on fossil fuels.

3. What are the social and governance implications of rising tariffs?

Higher tariffs can strain labor markets, disrupt cross-border supply chains, and limit access to technology and innovation. These pressures may weaken working conditions, reduce competitiveness, and create governance challenges for globally integrated industries.

4. How do tariffs affect corporate ESG performance and ratings?

Tariffs can negatively influence corporate ESG performance by increasing costs, emissions, and operational risks. Prolonged trade barriers may also affect country and company ESG ratings as economic resilience and sustainability investments weaken.

5. What is the long-term sustainability outlook under increased trade barriers?

Over the long term, sustained tariffs may reduce economic productivity and global cooperation, leading to fragmented sustainability frameworks. This could slow collective progress on climate action and weaken incentives for coordinated, global ESG initiatives.

Contributor

Aymen Karoui

Head of Methodology