Address unmanaged material ESG issues and align with responsible investment expectations set by increasing regulatory and market pressure. Inrate’s ESG engagement process takes on the work and delivers you the results by engaging with target companies on material ESG issues, tracking the progress, and enabling you to easily report on your ESG engagement progress.

A Pressing Need: ESG Engagement Solutions

Today’s investors face a complex ESG landscape. Unmanaged ESG risks can threaten portfolio performance. Responsible investment expectations are rising, driven by the PRI , new Stewardship Codes, and increased legislative pressures. Inrate’s Engagement Services empower you to proactively address these challenges by engaging with target companies on your behalf and working with them to propel ESG impact.

Features of Engagement Services

Align with Stewardship Codes and Regulatory Frameworks

through active and goal-oriented engagement services.

Easily Measure, Track, and Report on Your ESG Achievements

using Inrate’s proprietary engagement tool and engagement reports.

Get Insights from Top ESG Specialists

Get Insights from Top ESG Specialists by becoming a part of the Responsible Shareholder Group with 100+ billion in managed assets.

Ensure Objectivity and No Conflicts of Interests

harnessing Inrate’s commitment to service only institutional investors and keeping away from managing assets.

Inrate’s ESG Engagement Strategy

Choosing ESG Topics That Matter

All material topics are selected annually using a double-materiality perspective, developed through an active dialogue between the Responsible Shareholder Group and Inrate's top ESG experts.

Active and Goal-oriented Dialogue

We engage in thorough and goal-oriented dialogues with target companies within the Swiss Performance Index (SPI) on selected material ESG topics. We use extensive KPIs to constantly track their progress.

Easy Tracking and Reliable Reporting

All information relevant to the engagement process is available real-time on Inrate’s proprietary engagement tool. At the end of the engagement cycle, we also provide detailed reports that cover material ESG topics, targets, progress, and achievements.

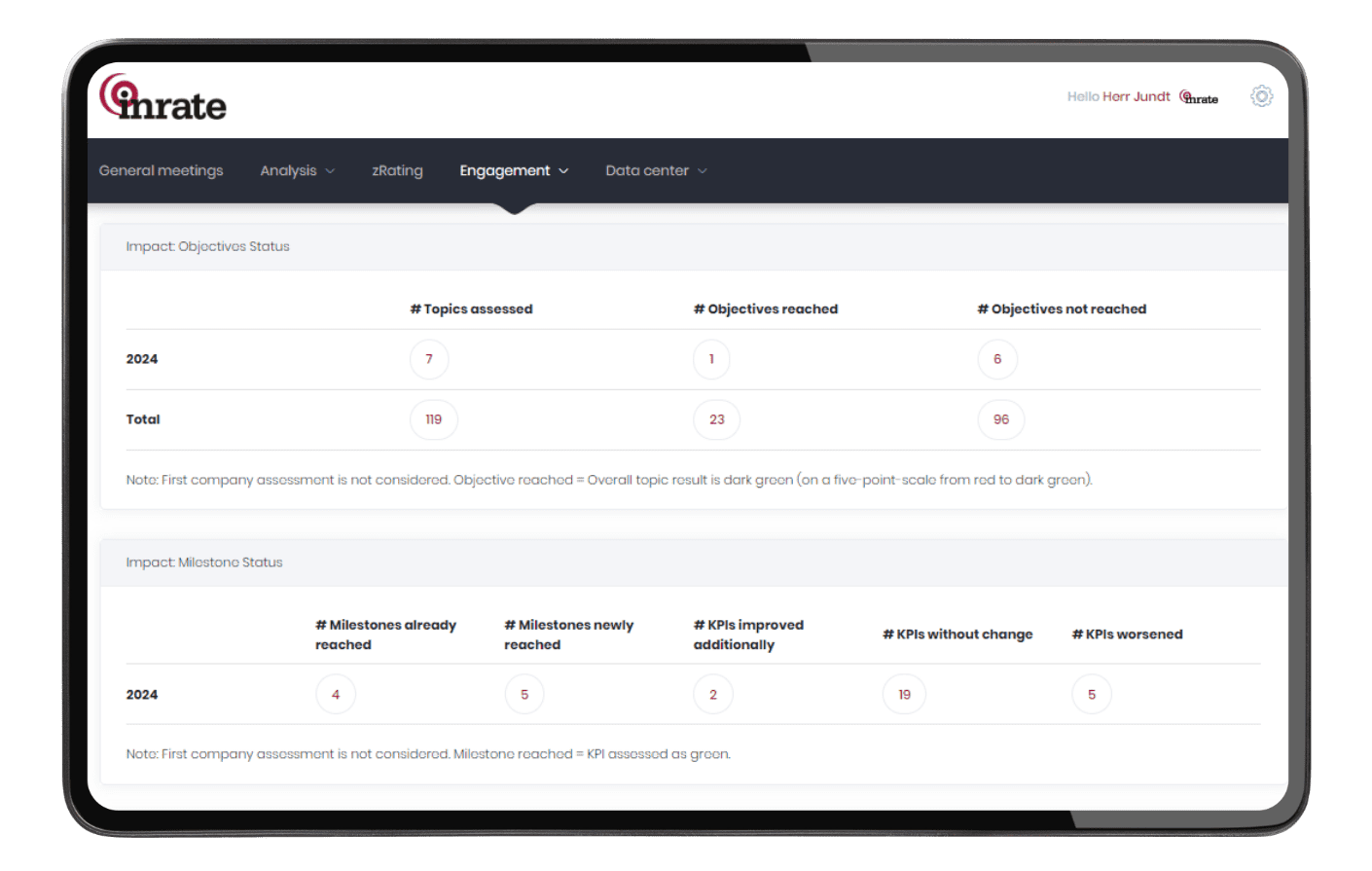

Inrate’s Engagement Tool: Your destination for all current and historic engagement data

Data from Inrate’s Engagement Platform is easily extractable for inclusion in company reports, portfolio analysis, and portfolio reporting. All data is accessible via browser and is stored in a server based in Western Europe.

Why Inrate

Impact Lens

Inrate has balanced financial materiality with impact well before 'double materiality' gained prominance in European Capital Markets. The impact of a company's business activities has stood at the core of Inrate's assessments, overcoming the biases created by disclosures.

Flexible Data Models

Inrate’s research can be customized to develop comprehensive datasets based on the client’s investment objectives and evolving regulatory requirements. This unmatched customization utilizes meticulous research on the impact of business activities, corporate sustainability disclosures, and ESG controversies.

Dedicated Client Support

Inrate operates as a ‘glass box’ with an unparalleled commitment to transparency and communication. We deliver unequivocal support from our long-standing team of research analysts, providing insights from our extensive research and subject matter expertise.

Regulatory Alignments

Inrate’s data lake evolves in tandem with new regulatory frameworks, consistently empowering clients to uncover their portfolio’s regulatory conformity. Our datasets promise relevance and materiality with the evolving sustainability market.