Introduction

The ESG (Environmental, Social, and Governance) investing space is transforming dramatically. Once considered a niche market, ESG funds have become a major force in global finance, attracting trillions of dollars in Assets Under Management (AUM). However, the road ahead is anything but straightforward.

As political landscapes shift, regulatory frameworks evolve, and economic conditions fluctuate, ESG investing is entering a new phase. While Europe continues to lead the charge, the U.S. market faces increasing fragmentation due to political divisions and legal challenges. Asia-Pacific is emerging as a powerhouse, with countries such as Taiwan and China driving strong ESG investment flows.

This blog explores the key factors shaping the ESG investing boom, from regulatory rollbacks and market trends to regional shifts and industry innovations. Whether you’re an investor, policymaker, or sustainability advocate, understanding these dynamics will be crucial in navigating the future of ESG investing.

Growing Influence of ESG Investing Funds

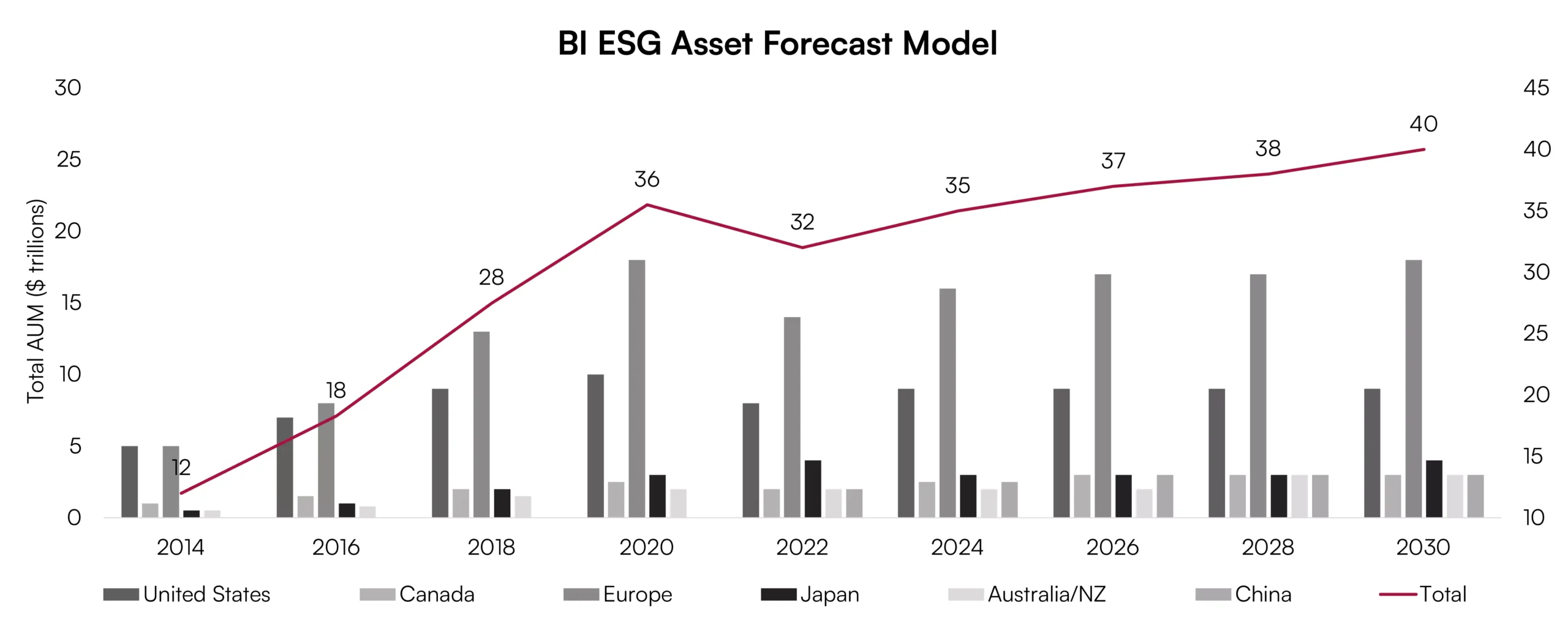

The ESG investing boom is entering a new phase, shaped by political shifts, regulatory changes, and market maturity. Bloomberg projects that global ESG AUM are expected to surpass USD 40 trillion by 2030, even as the U.S. market faces headwinds. While Europe will continue to drive ESG demand, the U.S. market is undergoing a steady transformation, with its share of global ESG assets projected to decline from 36% to around 23% with rising legal risks and deepening political divisions. Even though Trump has pulled the U.S. out of the Paris Agreement, 24 states are still sticking to its goals. This could make the ESG landscape a bit fragmented despite the resilience of the movement.

Read more: Discovering Impact Through Our ESG Ratings

Figure 1: ESG AUM Growth Across Key Markets

Source: Bloomberg

SEC Rolls Back Climate Disclosure Rule, Raising Uncertainty for ESG Investors

The U.S. Securities and Exchange Commission (SEC) is pulling back on its climate disclosure rule, which would have required publicly traded companies to report climate-related financial risks. This move isn’t a surprise, given President Donald Trump’s stance against ESG policies and his administration’s broader effort to cut back on climate regulations.

This rollback increased uncertainty for ESG investing and corporate sustainability efforts in the U.S. Without a clear federal standard, climate reporting could become messy and inconsistent, making it harder for investors to gauge climate-related risks.

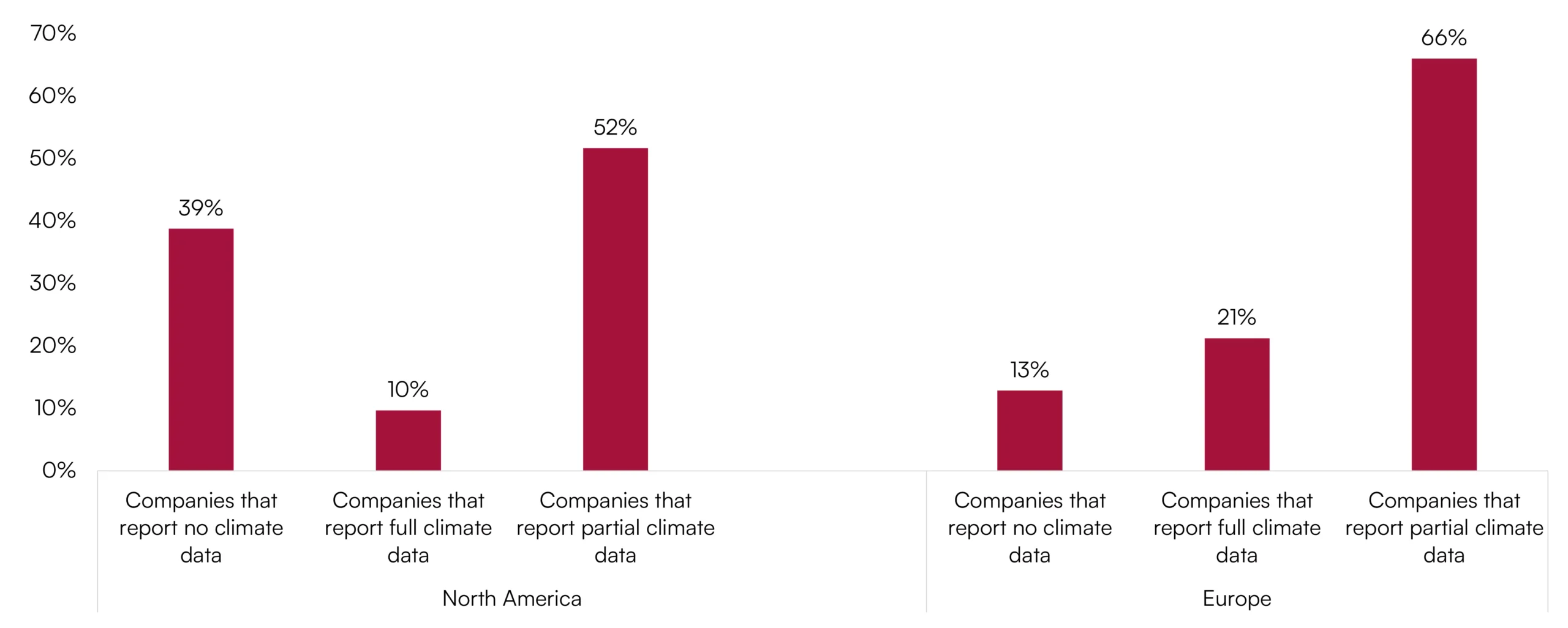

According to Inrate’s data, European companies are more committed to climate reporting than companies in North America. Only 13% of the companies in Europe did not report climate data, compared to 39% in North America. Additionally, 21% of European companies provided full climate data, which is more than double the 10% in North America. Furthermore, 66% of European companies reported partial climate data, compared to 52% in North America.

Figure 2: Climate Reporting: North America vs. Europe 2023-24

Source: Inrate

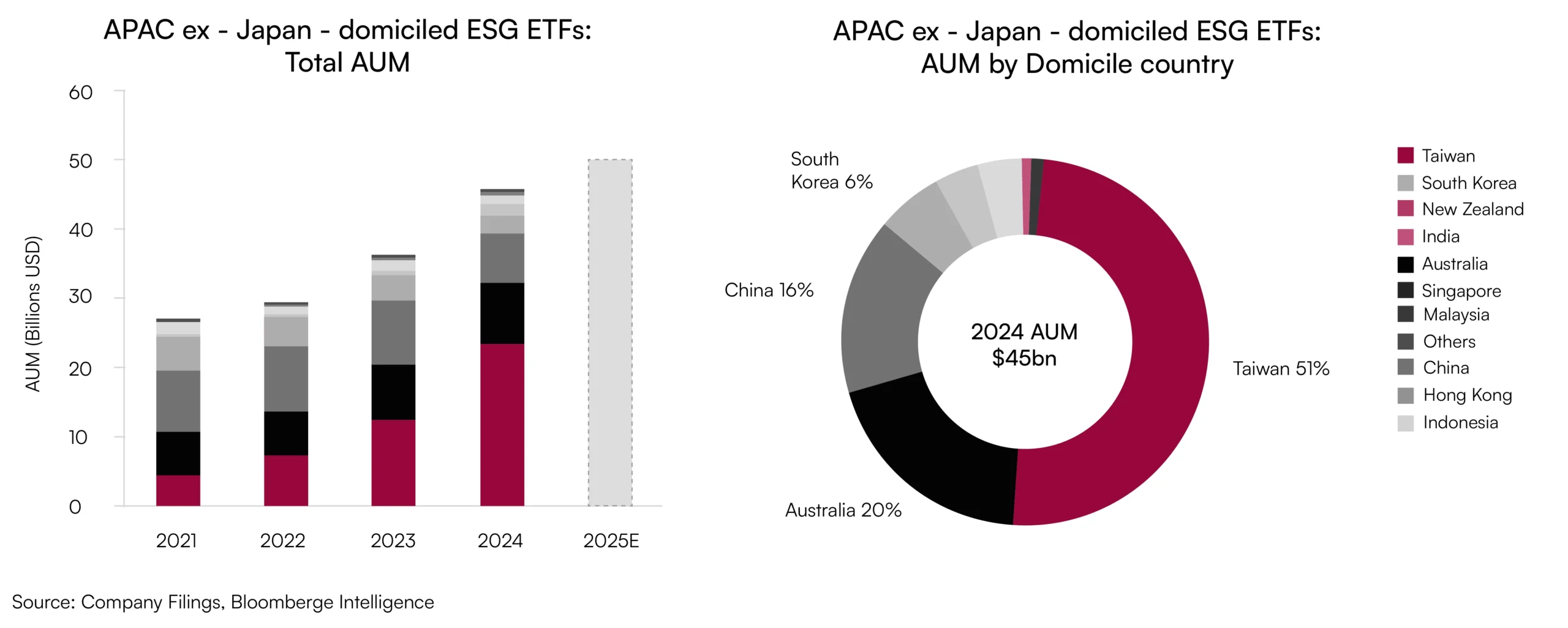

While the U.S. is struggling with the pushback against ESG investing, Asia-Pacific is on the right trajectory, with the region’s ESG ETFs growing by 10% annually and expected to hit a record USD 50 billion in 2025. Taiwan and Mainland China are at the forefront in driving this momentum.

Taiwan, which accounts for over 50% of the region’s ESG assets, is expected to see sustained inflows driven by strong investor interest in green technology and Artificial Intelligence (AI), while Mainland China’s clean energy ETFs, which faced a sluggish 2024, could see a rebound with the solar industry benefitting from an easing supply glut and EV manufacturers gaining momentum from extended subsidies.

Read more: Impact Investing Trends

Figure 3: ESG ETF AUM/Share of Assets in Asia-Pacific (Excl. Japan)

Source: Bloomberg

Climate Reporting by Asia-Pacific Companies 2021 and 2023

Regulators across Hong Kong, Singapore, Korea, and Japan are advancing ESG disclosure requirements alongside corporate reforms. Taking cues from international practices, they are adopting a more pragmatic approach, ensuring that regulations align with market dynamics while easing expectations to facilitate a smoother transition. From 2025, Hong Kong and Singapore will mandate climate reporting—the relaxation of Scope-3 requirements reflects this measured strategy. In Japan, increasingly stringent ESG regulations have led to a decline in the number and size of ESG fund launches, which could further drive regulatory momentum.

Corporate reforms will be a key focus across Asia-Pacific (APAC) in 2025, with Japan, Korea, and China undertaking initiatives to strengthen corporate governance, optimize capital efficiency, and enhance shareholder returns.

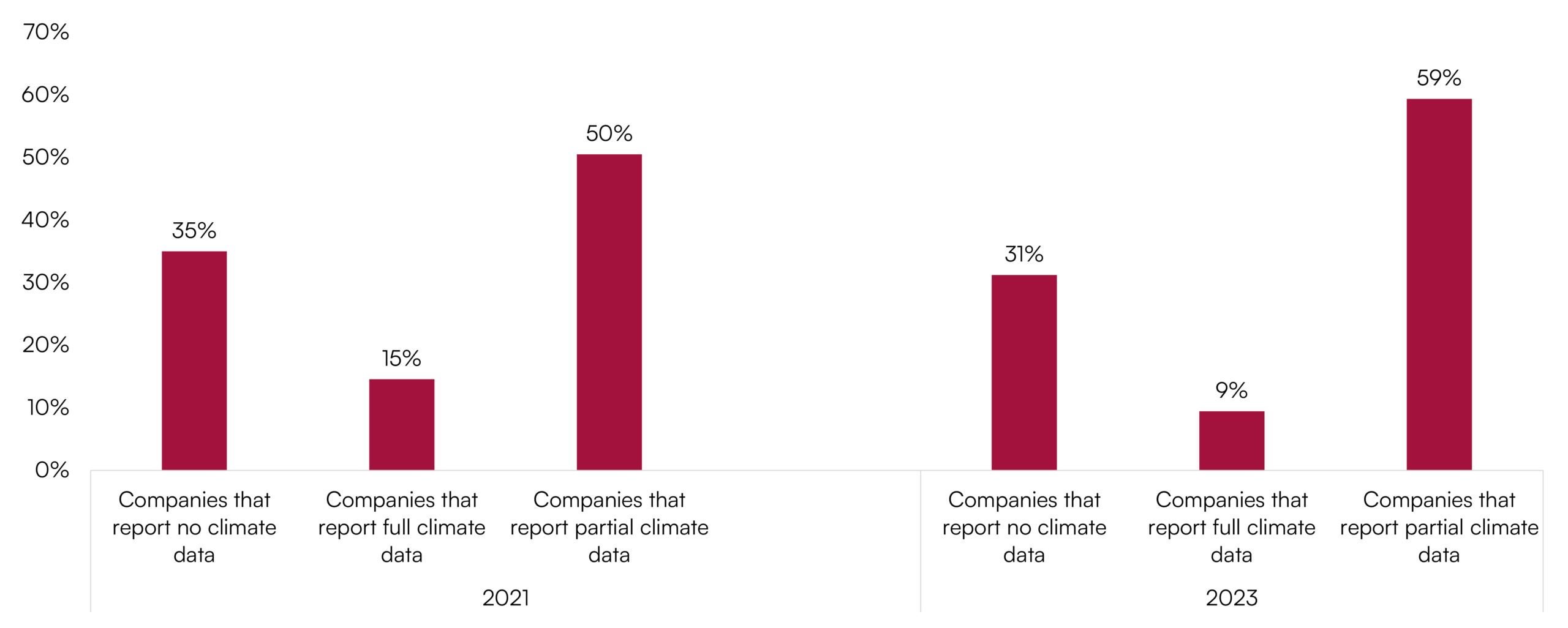

According to Inrate’s data, climate data reporting among Asia-Pacific companies changed notably between 2021 and 2023. The percentage of companies not reporting climate data decreased from 35% in 2021 to 31% in 2023, indicating a slight improvement in transparency. However, the share of companies providing full climate data declined from 15% to 9% during the same period, suggesting a reduction in comprehensive climate disclosure. Furthermore, the proportion of companies reporting partial climate data increased from 50% to 59%, reflecting a growing trend where more companies are engaging in climate reporting but opting for partial rather than full transparency. This indicates that while Asia-Pacific companies continue to progress in climate disclosure, there is still room for improvement in terms of providing complete and detailed climate data.

Figure 4: Climate Reporting by Asia-Pacific Companies 2021 and 2023

Source: Inrate

With strong market drivers and evolving regulations, Asia-Pacific is poised to remain a key player in the global ESG landscape.

Key Trends Driving ESG Fund Flows

Several major trends are anticipated to shape ESG fund flows in 2025:

Market Outlook

- AUM & Macro Climate: Despite the growing opposition to ESG investments, the market is projected to reach USD 40 trillion by 2030. This growth suggests that ESG-focused investing will remain strong in the face of political and regulatory challenges.

- Tackling Red Tape: Policymakers in the European Union (EU) and APAC are looking to streamline ESG regulations and reduce bureaucratic hurdles. This could lead to more efficient compliance processes and encourage greater ESG investments.

- Backlash & Greenhushing: Cultural tensions around ESG are intensifying in the U.S. Companies are responding by practicing ‘greenhushing’—continuing their ESG commitments without publicizing them to avoid political backlash.

- Rebranding & Financing: ESG-related debt markets are evolving, with funds being rebranded and relabeled to meet investor demand.

- Themes & Quantamentals: Investors are increasingly focusing on thematic investing, where ESG is integrated into ‘quanta mentals’ (fundamental analysis). This means that companies with strong ESG practices could see improved financial fundamentals and long-term growth.

Read more: Difference Between ESG and Impact Investing

Industry Outlook

- Grid Spending & Efficiency: The energy sector is prioritizing cost-efficient power generation and grid upgrades. With growing electricity demand, investments in infrastructure and smart grids are expected to be critical in 2025.

- Carbon Removal: New technologies, such as direct air capture and carbon sequestration, are becoming commercially viable. These innovations could create new revenue streams for industries while helping them meet climate targets.

- Muni Debt Climate Risk: Municipal bonds may face higher borrowing costs due to climate-related risks. Governments and investors will need to navigate these financial pressures, with climate change increasing infrastructure vulnerabilities.

- Natural Capital: Companies and regulators are focusing on biodiversity, ecosystem services, and natural resources. There will be a growing demand for better data, disclosures, and transparency in how businesses impact and depend on nature.

- Supply Chains: Trade policies and regulatory shifts are creating new risks for global supply chains. Companies must adapt to changing compliance requirements, geopolitical tensions, and climate-related disruptions.

These trends highlight the continuing importance of ESG factors in both market growth and industrial transformation.

Challenges and Criticism

Despite strong investor interest, several challenges could impact ESG fund flows in 2025. Regulatory uncertainty remains a major hurdle, with the EU tightening ESG fund-naming rules and disclosure requirements, forcing many funds to rebrand or adjust strategies. Political and legal risks also pose a significant threat, particularly in the U.S., where the anti-ESG sentiment continues to grow. Legal challenges and state-level restrictions are making it more difficult for ESG funds to operate. Simultaneously, the increased scrutiny of greenwashing could lead to lawsuits, fines, and reputational damage for funds that fail to meet sustainability claims.

Transition investing faces obstacles, with clean energy sectors still recovering from past underperformance. While declining interest rates could boost investments, the uncertainty around the future of clean energy subsidies in the U.S. remains. With the evolution of ESG investing, these challenges are highlighting the complexities that investors must navigate in an increasingly uncertain landscape.

Conclusion

ESG investing is evolving, shaped by changing regulations, politics, and market forces. Europe continues to lead the charge, while the U.S. grapples with an increasing division—some states doubling down on sustainability, with others rolling back regulations and challenging ESG policies in court. This tug-of-war indicates that ESG investing in the U.S. is expected to remain resilient despite becoming increasingly fragmented.

Asia-Pacific is stepping up as a major player, fueled by the growing demand for green tech and clean energy and increasing AI-driven ESG investments. Taiwan and Mainland China are at the forefront, backed by strong policies and investor confidence in sustainable industries.

However, the challenges remain despite considerable progress. Greenwashing, regulatory uncertainty, and the financial viability of clean energy projects are still major concerns. The rise of AI has brought both promises and risks, raising questions about energy use, misinformation, and data privacy.

As we move through 2025, ESG investing is becoming more complex. Investors will need to stay agile to be able to navigate the evolving policies, economic shifts, and technological advancements. The sector’s long-term success will depend on how well it adapts to these challenges while staying true to its core values of sustainability, transparency, and impact.

FAQs - Future of ESG investing

1. What is driving the future of ESG investing in 2025?

The future of ESG investing is shaped by regulatory rollbacks, political divisions, and market maturity. Europe remains the leader, Asia-Pacific is rapidly growing, and the U.S. market faces fragmentation amid legal and political headwinds.

2. How are regulations influencing ESG investing in 2025?

Regulatory frameworks are evolving unevenly worldwide. Europe continues to tighten standards, Asia-Pacific introduces pragmatic disclosure rules, while the U.S. faces rollbacks and state-level restrictions. This regulatory divergence makes compliance, transparency, and investor strategies increasingly complex across global markets.

3. Why is Asia-Pacific emerging as a major ESG hub?

Asia-Pacific is growing due to strong inflows into green tech, clean energy, and AI-driven ESG investments. Taiwan dominates regional ESG assets, while China benefits from subsidies for solar and EV industries, positioning the region as a global sustainability leader.

4. What challenges could slow ESG investing growth?

Key challenges include regulatory uncertainty, anti-ESG political pushback, greenwashing risks, and underperformance in clean energy sectors. These hurdles increase legal risks and investor skepticism, making robust disclosure, credible strategies, and adaptive portfolio management critical for sustainable growth.

5. How should investors prepare for ESG investing trends beyond 2025?

Investors should diversify across regions, integrate both financial and impact metrics, and remain agile amid shifting regulations. Focusing on transparency, technology-driven opportunities, and long-term sustainability themes will be essential for navigating ESG investing’s evolving global landscape.

Contributor

Kiran Ambekar

Senior Analyst